Das also stressed the importance of bank CEOs giving particular attention to enhancing governance and prioritizing the three pillars of banking stability, which encompass compliance, risk management, and audit functions.

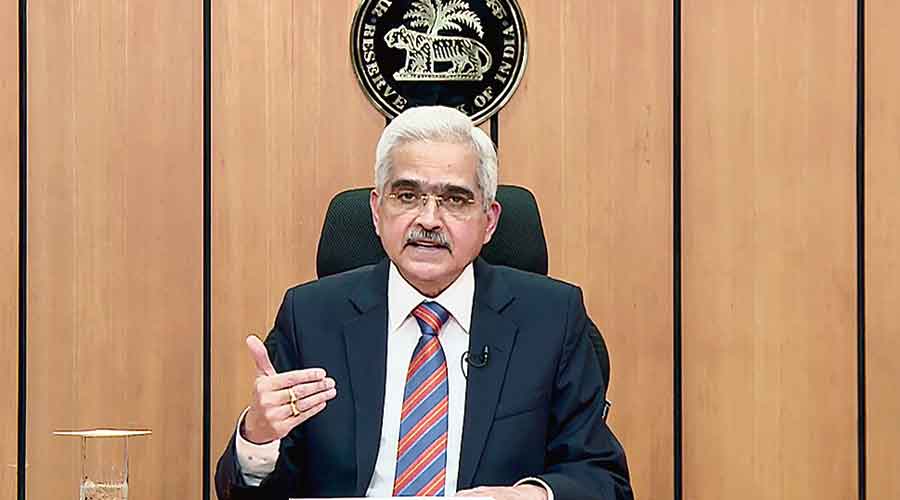

Despite the commendable performance of Indian banks in a challenging global landscape, RBI governor Shaktikanta Das cautioned the leaders of private and state-owned banks against complacency. He urged them to remain vigilant and not lower their guard.

In a statement, the RBI mentioned that Das held a meeting with the CEOs of public sector banks and a few private sector lenders on Tuesday.

The statement highlighted that during his opening remarks, the governor acknowledged the commendable performance of the Indian banking system amidst challenging global circumstances. However, he emphasized the importance of banks exercising additional caution and vigilance during such times.

The RBI further stated that Das underscored the significance of bank CEOs prioritizing the enhancement of governance and focusing on the three pillars of banking stability, which encompass compliance, risk management, and audit functions.

The discussions also encompassed various other topics, including the reinforcement of credit underwriting standards, effective monitoring of significant exposures, adherence to the external benchmark linked rate (EBLR) guidelines, and the enhancement of information technology (IT) security and IT governance. Additionally, Das emphasized the importance of improving the recovery process for written-off accounts and ensuring the prompt and accurate sharing of information with credit information companies.

Das has consistently emphasized the necessity for banks to fortify their corporate governance standards. During a conference of bank board directors in May, Das expressed concerns over instances where banks employed innovative methods to conceal the true status of stressed loans, raising issues about potential attempts to evergreen loans. Evergreening loans refers to the practice of granting fresh loans to borrowers who are on the brink of default, allowing them to repay existing loans.

"In various instances, these methods involve the collaboration of two lenders to evergreen each other's loans through the sale and repurchase of loans or debt instruments, or the persuasion of creditworthy borrowers to enter structured deals with stressed borrowers in order to hide the financial strain," stated Das in May.

.jpg)